Note: This blog was initially published prior to the introduction of the UK autonomous financial sanctions regimes under the Sanctions and Anti-Money Laundering Act (the Sanctions Act). Regulations made under the Sanctions Act define the meaning of “owned or controlled directly or indirectly”.

It is relatively straightforward to find out if an individual is subject to financial sanctions. You can search OFSI’s consolidated list and see if you get a match. Signing up to OFSI’s e-alerts also means you’ll be notified when there are updates to the consolidated list. But in some cases, it can take more effort to establish if a company is subject to financial sanctions. Usually, you can just perform a simple search like the one described above, but some companies have more complicated ownership structures. They may be owned by a designated person (someone subject to financial sanctions) and checks beyond the scope of OFSI’s consolidated list are required to establish who owns them.

Ownership and Control

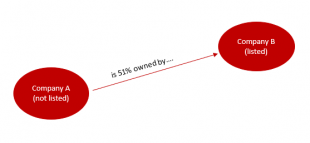

In the example below, Company A may not show up as a sanctioned entity, but it is 51% owned by company B which is a sanctioned entity. This means financial sanctions would bite for company A as well as company B.

Some sanctioned entities deliberately use shell companies to try and obscure their ownership structure. If you are finding it difficult to establish who is the owner of a company, it could be a potential red flag for conducting business with them.

Be aware that ownership and control structures can also change. A designated person may sell some of the shares they own in a company, which could mean payments made to that the company are no longer caught by financial sanctions. They could also increase their shareholding, which would mean the company is now subject to financial sanctions.

Ownership and control also includes having a majority of voting rights or the ability to appoint or remove the majority of members of the management of a company. For further guidance on what constitutes ownership and control, read chapter 4 of OFSI’s general guidance. An individual could also be controlled by a family member or friend who is using the individual to enter into transactions.

Libya case study

The Libya Africa Investment Portfolio (LAIP) is part of a large sovereign wealth fund called the Libyan Investment Authority (LIA). The UN listed both these companies under a partial asset freeze on 16 September 2011. LAIP’s real estate arm, the Libyan Arab African Investment Company (also known as LAAICO or LAICO), is subject to a full asset freeze under the UK Libya (Sanctions) (EU Exit) Regulations 2020.

LAICO has a subsidiary called ‘Ledger Hotels’ and they partially own or control several high-end hotels across the African continent. These hotels are listed on popular online travel providers.

Although these hotels are easy to book with and found on various online platforms, they may still be subject to financial sanctions. We cannot make a generalisation about this group of hotels as the ownership structure varies from one to the other. If you or your organisation stays in one of these hotels, uses a conference room there, or makes any funds available in exchange for goods and/or services without an OFSI licence*, you may be in breach of UK financial sanctions. Sometimes, companies only become aware of this when their bank blocks payment to the hotel, leaving them unable to pay their bill.

It is imperative that due diligence is carried out and you satisfy yourself that you are not transacting with a hotel controlled by a sanctioned entity. We would strongly encourage anyone considering transacting with a potentially LAICO-owned entity to take independent legal advice and carry out extensive due diligence measures.

If you believe you may be dealing with an individual/firm subject to sanctions, you must:

- freeze their funds and assets immediately

- inform OFSI

- not deal with or make funds or economic resources available to them (unless there is an exemption in the legislation that you can rely on or you have a licence from OFSI)

- not do anything that would circumvent the asset freeze

For more information about financial sanctions, visit OFSI’s webpages and sign up for our email alert service.

If you have any questions or comments about the issues raised in this blog, please contact us on ofsi@hmtreasury.gov.uk.

*you may also require a licence from other competent authorities

Leave a comment