We have seen a growing focus on North Korean sanctions over the last year, with the number of targets on OFSI’s financial sanctions asset freeze list up by more than a third.

Sanctions play a key role in restricting North Korea’s nuclear proliferation and destabilising activities. Successive rounds of UN and unilateral sanctions have heavily restricted North Korea’s ability to acquire the goods and financial resources needed to build and buy nuclear weapons and delivery systems. The UN sanctions regime alone restricts the provision of almost everything from financial services to the import of luxury goods such as yachts and racing cars.

These restrictive measures are well known and have had a far-reaching effect on North Korea’s activities.

You may think that these robust sanctions preclude North Korea from even attempting to circumvent sanctions; or that such frameworks would make these attempts obvious during the most basic ‘Know Your Customer’ (KYC) or due diligence checks. But recent events have confirmed that North Korea continues to find ways to circumvent these international controls around the world.

Circumvention of the sanctions’ regimes generally falls into two categories:

- Physically obtaining materials for North Korea’s ballistic missile and nuclear programme.

- Gaining access to the international financial system and foreign currency through the trading of a variety of goods or services, produced both inside and outside of DPRK.

The first of these is typically the area that is best understood when it comes to due diligence and compliance. The second is less clear-cut.

Accessing financial markets and foreign currency is essential to North Korea’s continued proliferation activity. The efforts undertaken by actors, inside and outside North Korea, to enable the regime to do this are multi-faceted and complex. Like all illicit finance, those operating in the interests of the North Korean state seek to hide both the source and destination of any financial or economic resources they use or acquire. Such illicit financial activity is not constrained to the geographic areas bordering North Korea but has a global presence.

So how do you best protect your company from this risk?

There is no easy answer. The individuals and groups working for North Korea have been doing so for many years and are experts in effectively masking their activities. However, we can offer three tips.

Understand your risk and potential exposure

Even if you believe there is little chance of being targeted, you should consider how you may be indirectly targeted.

Understanding this risk is for you and your compliance team to properly assess and, because every business is different, there is no definitive checklist that is applicable to all businesses.

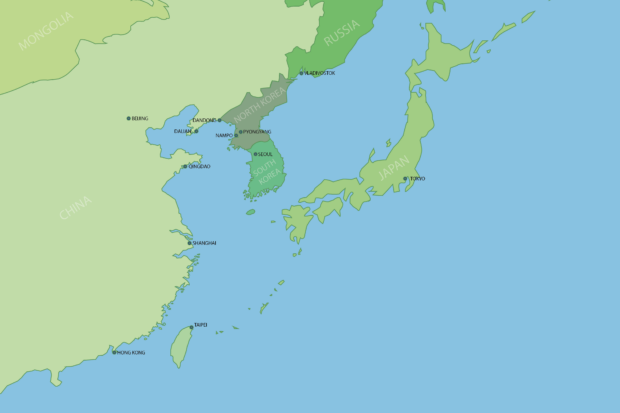

However, you can look at your geographic exposure to countries and trade hubs that are closest to North Korea. Regional trade hubs provide ideal operating environments for those seeking to evade sanctions, given the high volume of legitimate trade that illicit activity can hide in and their geographical proximity to North Korea.

DPRK uses extensive networks of front or ‘shell’ companies to mask its illicit activity. There is evidence that sectors as far-ranging as textiles and fisheries are often used as fronts, as well as the more widely-publicised coal exporters. These companies may not have an on-line presence – a potential red flag.

Take a different perspective

Consider your activities, and the services you provide, from the perspective of a proliferator or individual seeking to undertake illicit activity. How might your services aid someone seeking to raise capital, launder money or pay for and ship goods into North Korea? This is a good way to identify areas where you could implement greater due diligence.

Engage critically with your customer and trading data

An important element here is, of course, customer and trading data. If you don’t have the data to allow you to understand your exposure and how your business might be targeted, you should consider whether you are obtaining enough information from your customers and making the best use of this data to protect your business.

Refreshing your checks on a regular basis, and when sanctions regimes change, is an important part of ensuring that you have done adequate due diligence – not doing so can put you in breach of financial or trade sanctions.

You can keep up to date with changes to financial sanctions regimes by signing up to OFSI’s email alerts. If you have a specific query, or would like to report suspicious activity including sanctions breaches or dealing with an asset freeze target, you can contact us directly. Likewise, if you need to undertake legitimate business or provide humanitarian aid, please look at our regime pages and licence page.

OFSI strongly encourages you to seek independent legal advice if you have any concerns relating to financial sanctions.

Leave a comment